The Winnipeg real estate market set new records in 2016 in both number of sales and dollar volume.

There were 13,632 Winnipeg real estate sales in 2016, a 5% increase over 2015 and a 4% increase over the previous record of 13,079 sales in 2007. The dollar volume of $3.78 billion also represented an 8 percent increase over last year’s record high of $3.50 billion.

Annual records for dollar volume have been achieved for 16 consecutive years. This shows the average home selling price in Winnipeg has always managed to climb high enough each year to offset any years where sales were unable to match or eclipse the previous year’s total.

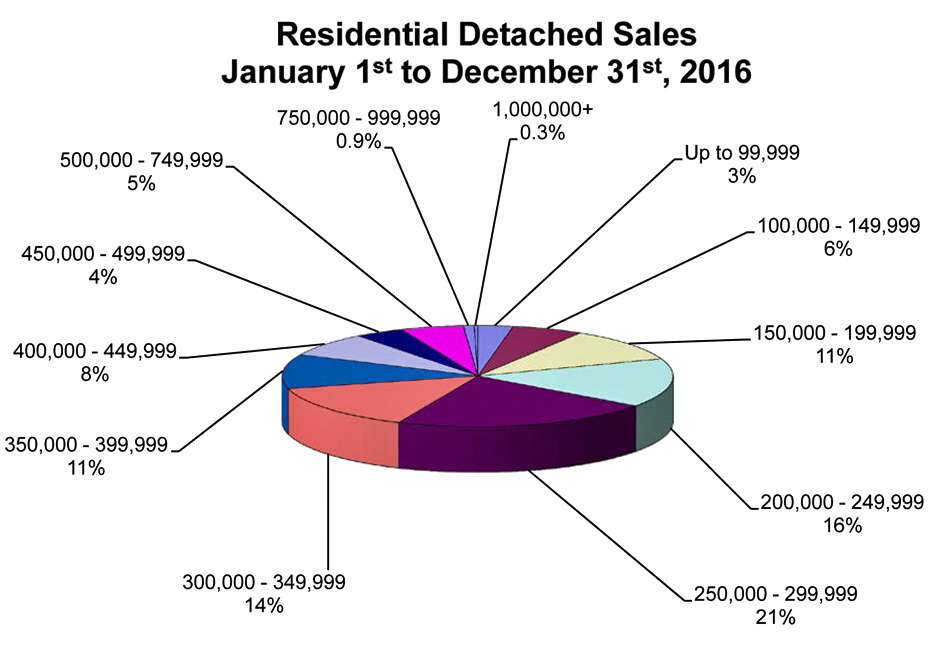

Speaking of average selling prices, the 2016 residential-detached average selling price in Winnipeg finished up 3% in comparison to 2015. The $302,727 recorded in 2016 is the first time the residential –detached or single family home average selling price has reached and edged over the $300,000 benchmark level. It should also be noted 2016 was also the first time residential-detached properties represent $3 billion in real estate transactions.

In respect to residential-detached sales activity throughout the various Winnipeg MLS zones and outlying rural areas, the rural zone gained nearly a percentage point of market share over 2015 to represent nearly 26% of total sales. Second most active was the southwest area of Winnipeg at 19%.

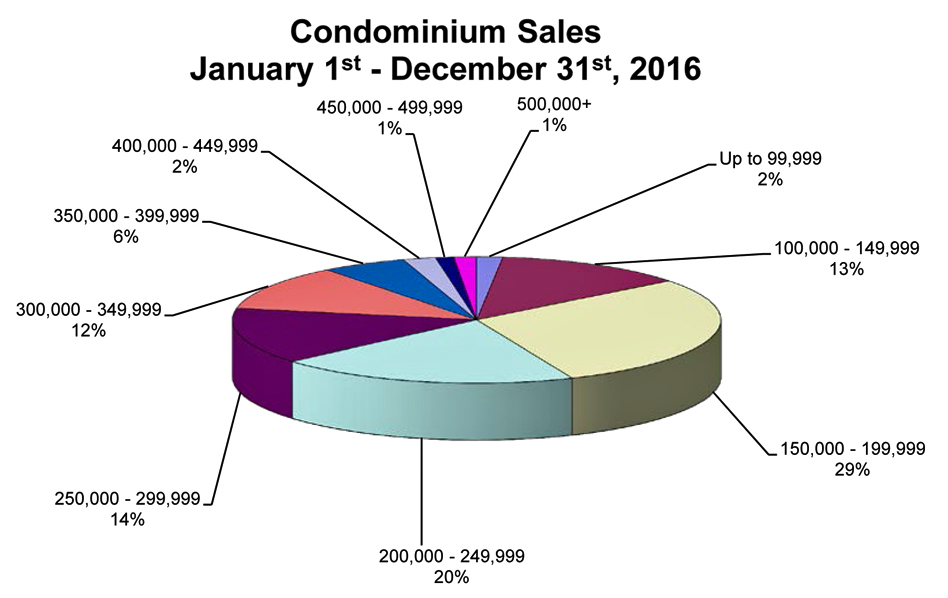

As for Winnipeg condominiums, the average selling price of $235,508 is down ever so slightly from the 2015 average selling price of $236,204. Without a doubt, the abundance of choice in condominiums- resale and new – has kept condominium prices in check. The average selling price has remained within the $230,000 to $240,000 price range since 2013.

Not surprisingly, to set a new annual sales record, 2016 residential-detached and condominium sales were impressive with the former reaching a new high of 9,947 and condos ending up at 1,745, second only to 2014’s 1,798 record total. Percentage increases over 2015 were 4 and 8% respectively.

Townhouse sales catapulted 34%, resort properties jumped 24%, vacant land 17% and mobile homes resulted in another double-digit increase of 12%.

Going into 2017, one important development is the new federal government-imposed changes to mortgage qualifying rules. These rules came into effect in the fourth quarter of 2016 so it is too early to tell how impactful they may be. Suffice to say, they are a real legitimate concern, and this is especially the case with first-time buyers. First-time buyers make up a key segment of the real estate market and their effect on the market and economy go well beyond their own.

Gregory Klump, CREA’s Chief Economist says, “First-time buyers support a cascade of other homes changing hands, making them the linchpin of the housing market.”

Another one to watch out for is the City of Winnipeg’s impact fee on new homes built in select suburban areas of the city. These new fees come in to effect on May 1st, 2017 and are roughly $5,100 per 1,000 square feet. If building permit applications are submitted prior to May 1st, applicants will not have to pay the impact fee as long as the permit is issued within six months and construction begins prior to November 1, 2017.

December Winnipeg Real Estate Highlights

December Winnipeg real estate unit sales totaled 617, a decrease of 4% compared to December 2015 and an 11% increase over the 10-year sales average for the month. Despite sales being down compared to last year, dollar volume in December totaling $167.9 million was up 5% over December 2015.

New Winnipeg real estate listings coming on the market were down 8% in December, while the active inventory at the end of the year fell under 3,000 listings, an 11% decrease in comparison to 2015.

While December was anticlimactic given that a new all-time annual sales record was set early in the month, it was disappointing how poorly, in general, some property types performed when compared to December 2015. It was not symptomatic of what was happening consistently throughout 2016. Residential-detached was an exception as it eked out a small gain over last year.

The most active price range in Winnipeg for residential-detached sales in December was the $250,000-$299,999 price range at 20% of total sales. 60% of total sales fell under $300,000.

The average days on market for residential-detached sales was 42 days, the same time on market as December 2015.

The most active price range for condominium sales in December was the $150,000-$199,999 at 33% of total sales. The second most active was the next higher price range of $200,000- $249,999 at 18% and not far behind was the $250,000-$299,999 range at 15%.

The average days on market for Winnipeg condo sales was 52 days, 19 days faster than December 2015.